franklin county ohio sales tax on cars

Franklin county ohio sales tax on cars. You can find more tax rates and allowances for Franklin County and Ohio in the 2022 Ohio Tax Tables.

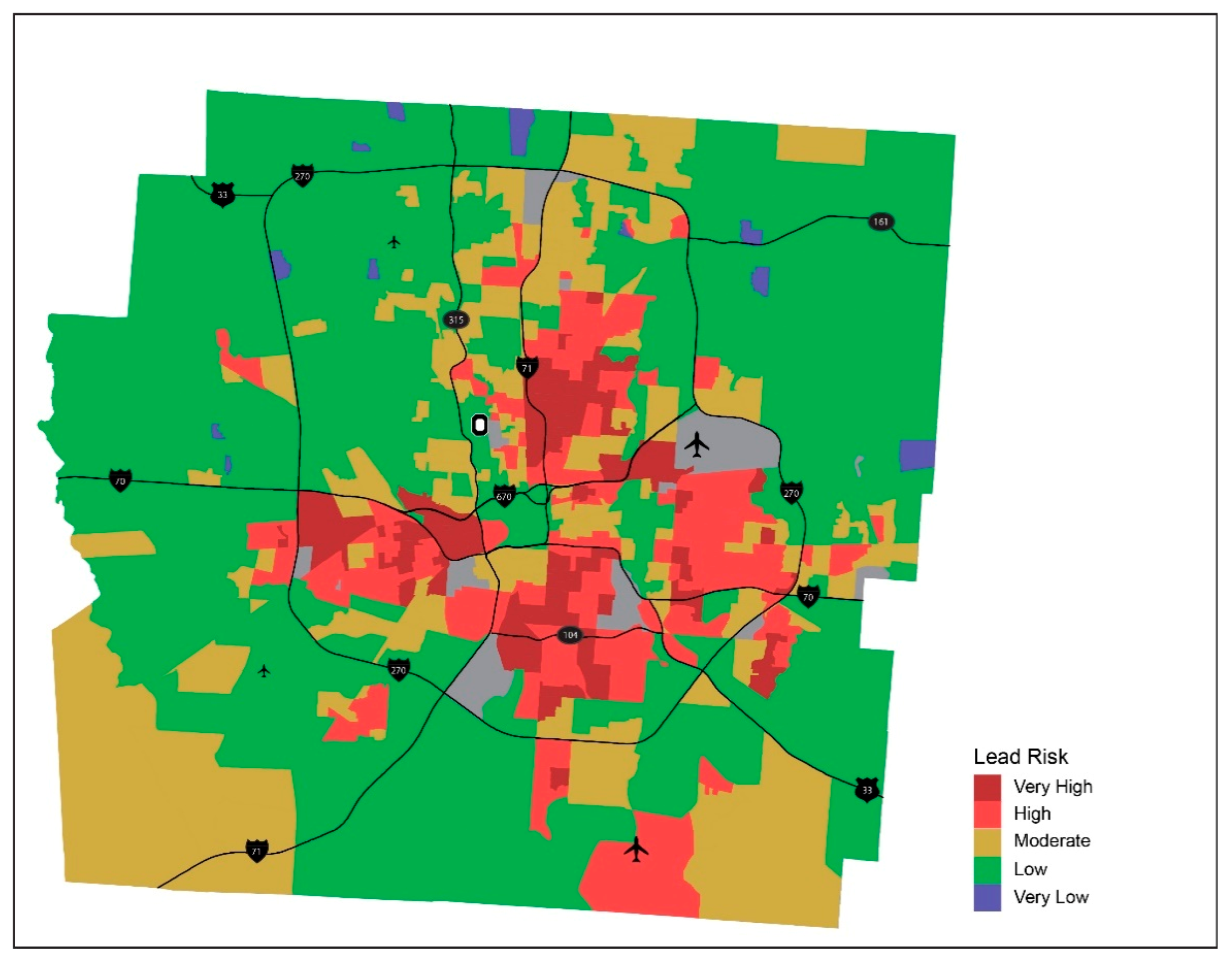

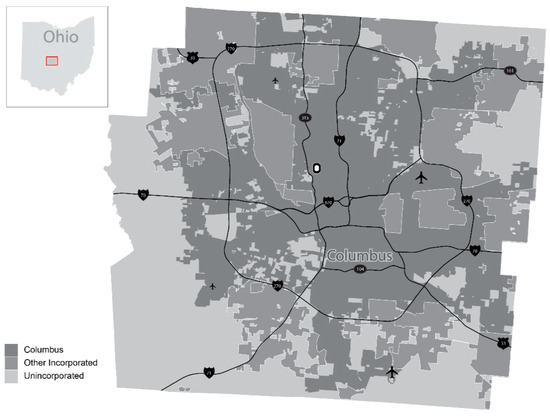

Ijerph Free Full Text Neighborhood Level Lead Paint Hazard For Children Under 6 A Tool For Proactive And Equitable Intervention Html

Franklin Countys is 75.

. Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin County totaling 175. Lowest sales tax 6 Highest sales tax 8 Ohio Sales Tax. 2022 List of Ohio Local Sales Tax Rates.

1500 title fee plus sales tax on. Auto repairs are regulated by Ohios Auto Repairs and Services Law. Enterprise Car Sales West County.

The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in Franklin County. Taxes are due on a vehicle even when the vehicle is not in use.

There are a total of 576 local tax jurisdictions across the state collecting an. Below are some examples of what parts of certain auto repairs are taxable. This is the total of state and county sales tax rates.

Additional evidence may be required based on unique titling situations. The minimum combined 2022 sales tax rate for Franklin County Ohio is. Franklin is in the following zip.

Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225. Overview of the Sale. The properties in community reinvestment areas in franklin county had an abated value of more than 42 billionwith about 111 million in taxes that werent collected under agreements with local.

All eligible tax lien certificates are bundled together and sold as part of a single portfolio. Have your car inspected at a new or used car dealership or any Deputy Registrar. If you have questions contact the Ohio Attorney Generals Office at 800 282-0515 or 614 466-4320.

Information can also be found online at wwwohioattorneygeneralgov. Some cities and local governments in Franklin County collect additional local sales taxes which can be as high as 075. Franklin County Sales Tax Rates for 2022.

The inspection forms are valid for 30 days from date of inspection. The County sales tax rate is. The December 2020 total local sales tax rate was also 7500.

Franklin county ohio sales tax on cars. The Ohio sales tax rate is currently. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency. The new Kansas law will drop the tax to 4 in January to 2 in 2024 and to zero in 2025. The state gets 575 percent which is the rate for all counties.

Did South Dakota v. We accept cash check or credit card payments with a 3 fee. The latest sales tax rate for Franklin OH.

Our office is open Monday through Friday 800 am. This includes the rates on the state county city and special levels. The Franklin sales tax rate is.

You may obtain county sales tax rates through the Ohio Department of Taxation. The Franklin County sales tax rate is. May 11 2020 TAX.

What is the sales tax on cars in Franklin County Ohio. The minimum combined 2022 sales tax rate for Franklin Ohio is. Bring in your out of state title inspection form and acceptable form of identification.

The minimum combined 2022 sales tax rate for Franklin Ohio is. The 2018 United States Supreme Court decision in South Dakota v. Please make checks payable to.

This is the total of state county and city sales tax rates. What county in Ohio has the lowest sales tax. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

Franklin OH is in Warren County. 6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales. 2020 rates included for use while preparing your income tax deduction.

No E Check Ohio Lawmakers Propose Getting Rid Of It R Ohio Enterprise Car Sales - We Transfer Cars. The NY sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. The Ohio state sales tax rate is currently.

The current total local sales tax rate in Franklin County OH is 7500. Average Sales Tax With Local. Butler County along with Stark and Wayne counties share the states.

1500 title fee plus sales tax on purchase price add 100 fee per notarization andor 150 for out-of- state transfers. Franklin County Clerk of Courts. 17TH FLOOR COLUMBUS OH 43215-6306.

This rate includes any state county city and local sales taxes. Wayfair Inc affect Ohio. If there is a lien on your title or for new purchases contact our office at 6145253090.

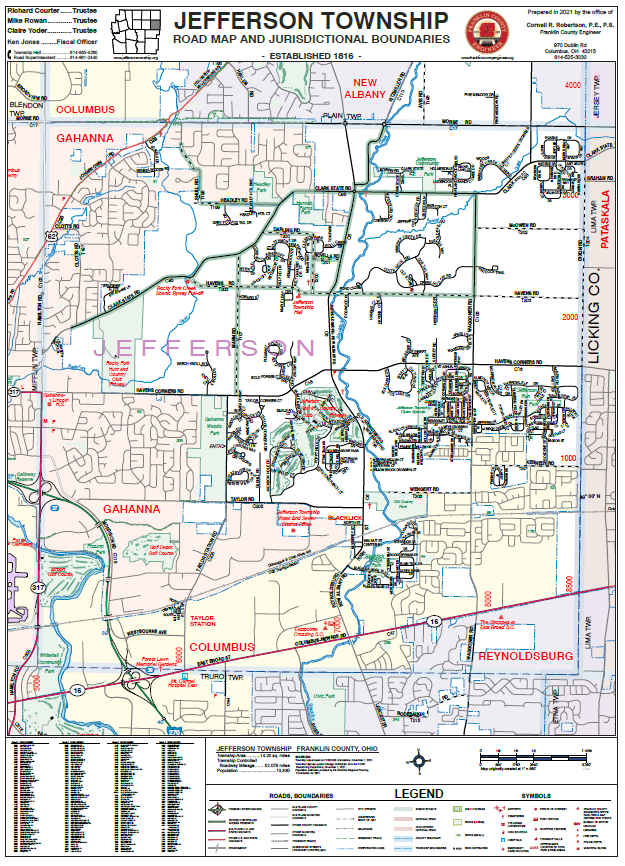

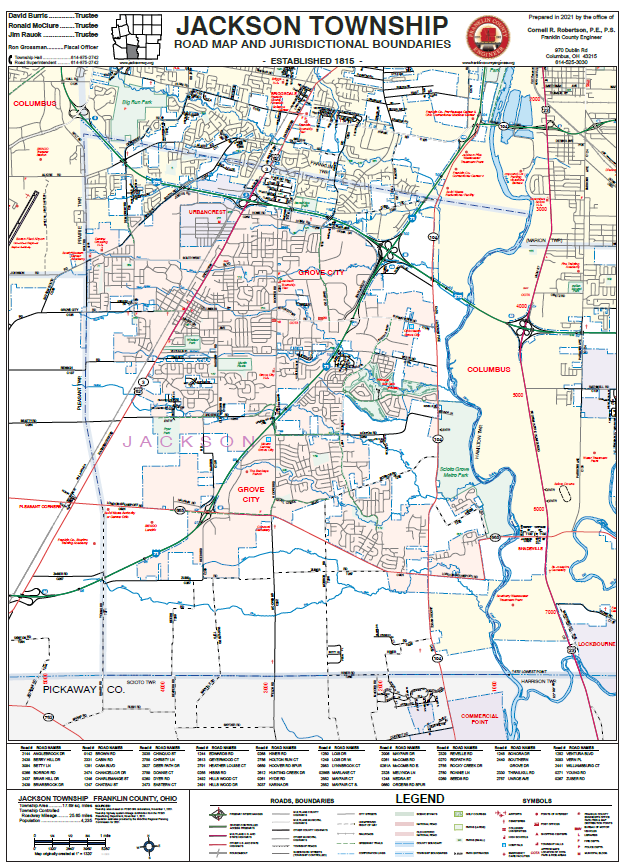

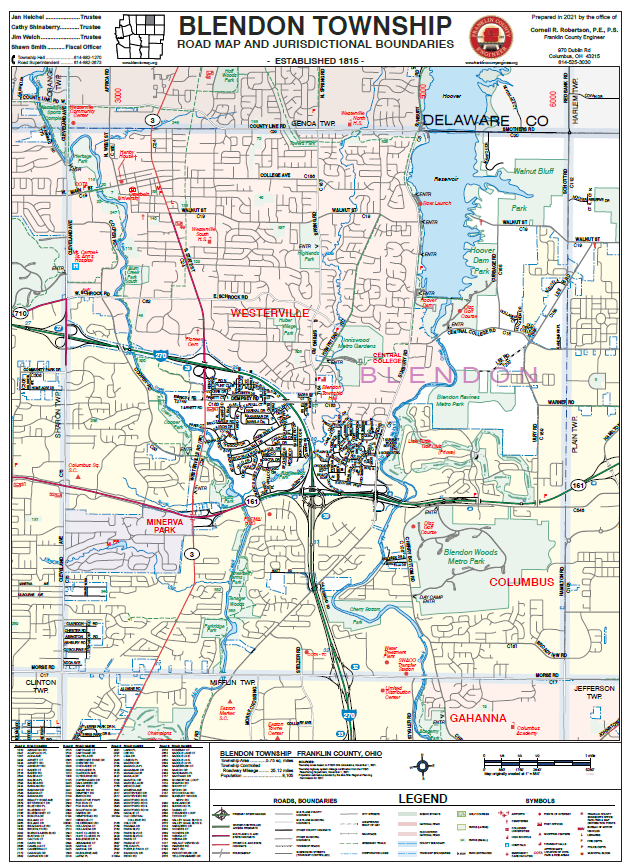

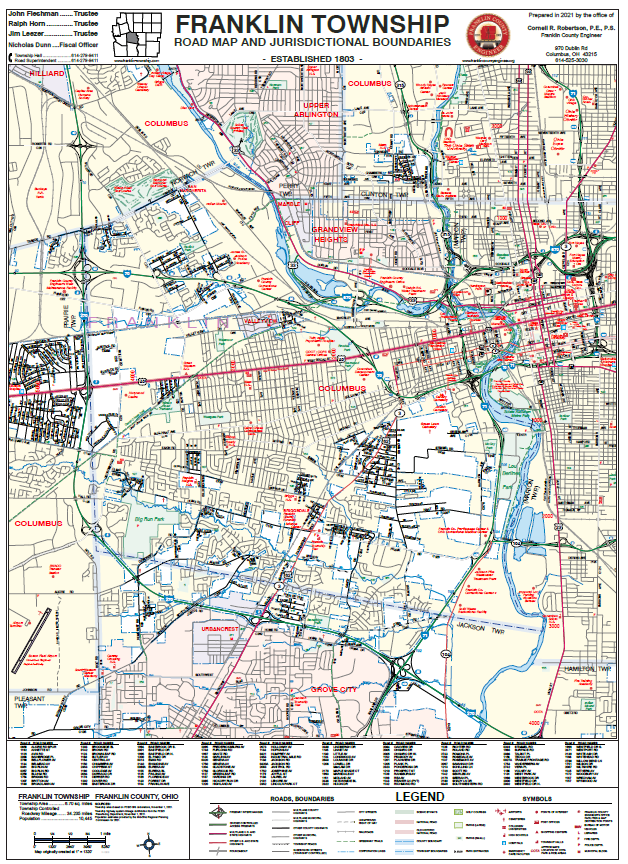

Township Maps Franklin County Engineer S Office

Local Property Tax Rates Rising Faster Than Inflation

Township Maps Franklin County Engineer S Office

Auto Title Manual Franklin County Ohio

Township Maps Franklin County Engineer S Office

New Court Order Instructions Franklin County Ohio

Demographics Franklin County Ohio

Demographics Franklin County Ohio

Township Maps Franklin County Engineer S Office

Franklin County Raising Plate Fees

Ohio Sales Tax Small Business Guide Truic

Franklin County Auditor Licensing Types

Step By Step Guide To The Franklin County Probate Process Columbus Real Estate

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ijerph Free Full Text Neighborhood Level Lead Paint Hazard For Children Under 6 A Tool For Proactive And Equitable Intervention Html