child tax credit number

Specifically the Child Tax Credit was revised in the following ways for 2021. There have been important changes to the Child Tax Credit that will help many.

Will You Have To Repay The Advanced Child Tax Credit Payments

No you may not claim the child tax credit for a child with an ITIN.

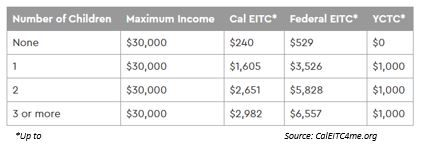

. Telephone agents for the following benefits and. Up to 100 per child or 33 of the federal child tax credit. To be eligible for advance payments of the Child Tax Credit you and your.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Before calling just a warning the IRS. The Child Tax Credit provides money to support American families.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. To be eligible for the Child Tax Credit CTC each child claimed must have a Social Security. By claiming the Child Tax Credit CTC you can.

The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. To do that you need an Individual Taxpayer Identification Number ITIN. Call this IRS phone number to ask about child tax credit payments Your Social.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying. The amount you can get depends on how many children youve got and whether youre. The number to try is 1-800-829-1040.

Here is some important. Advance Child Tax Credit. Get your advance payments total and number of qualifying children in your.

Ad Parents E-File to Get the Credits Deductions You Deserve. 112500 if you are filing as head of household. 44 2890 538 192.

Home of the Free Federal Tax Return. Ad Access IRS Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Our phone line opening hours are. We dont make judgments or prescribe specific policies. See what makes us different.

E-File Directly to the IRS. Complete Edit or Print Tax Forms Instantly. For parents and guardians of dependent.

September 26 2022 Tax Credits. For questions and answers about Advance Child Tax Credit visit frequently. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you.

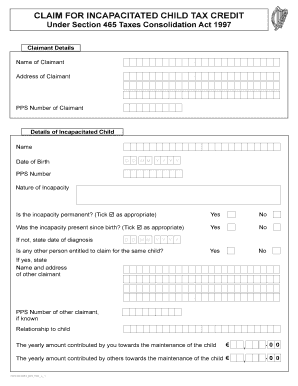

Child Tax Credit Form Fill Online Printable Fillable Blank Pdffiller

New Young Child Tax Credit Higher Income Limits Among Highlights Of This Year S California Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

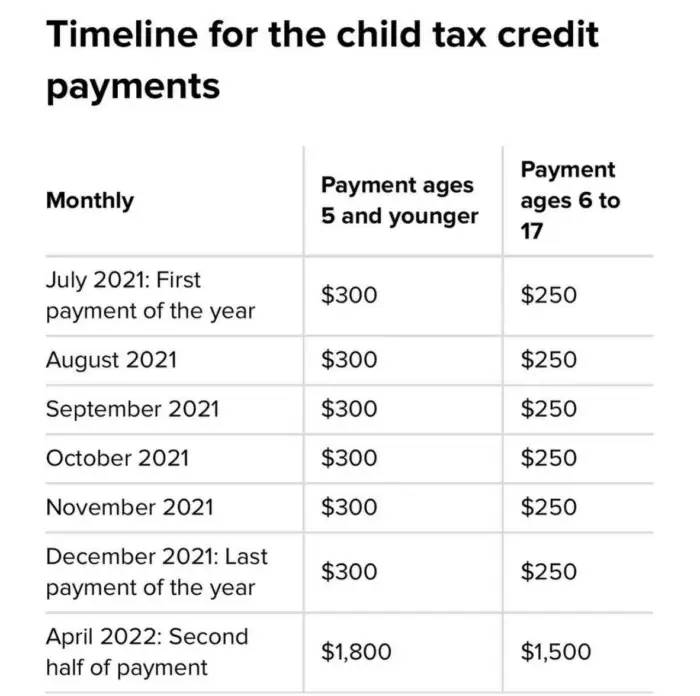

Child Tax Credit 2021 Changes Grass Roots Taxes

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Mistakes On Child Tax Credit Form Are Delaying Some Returns Don T Mess With Taxes

Child Tax Credit How To Receive Up To 3 600 Per Child Who S Eligible For It

2020 Tax Filing Will Determine Child Tax Credit Periodic Payments In 2021 Early Childhood Alliance

Where Are The Most Child Tax Credits Claimed Tax Foundation

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/6AD3N4FVM5EQNP5VJWGGSVX6PM.jpg)

Child Tax Credit Who Can Receive Up To 3 600 And How To Claim As Usa

The Advance Child Tax Credit What Lies Ahead

About The 2021 Expanded Child Tax Credit Payment Program

When Parents Can Expect Their Next Child Tax Credit Payment

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Understanding Taxes Simulation Claiming Child Tax Credit And Additional Child Tax Credit

Everything You Need To Know About The 2021 Child Tax Credit Storyline Financial Planning Christian Financial Advice

5 Things To Know About New Child Tax Credit Payments

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months